JP Morgan’s In-Depth Analysis: Four Key Factors Driving Ethereum to Outperform Bitcoin!

According to JPMorgan’s latest research report, Wall Street analysts attribute this phenomenon to four primary factors: improved ETF structure, increased corporate treasury holdings, a more accommodative regulatory stance, and the potential approval of future staking functionality. These drivers not only explain Ethereum’s recent outperformance, but also suggest it could have even greater upside potential going forward.

I. Market Backdrop: Dual Impact of Policy and Capital Flows

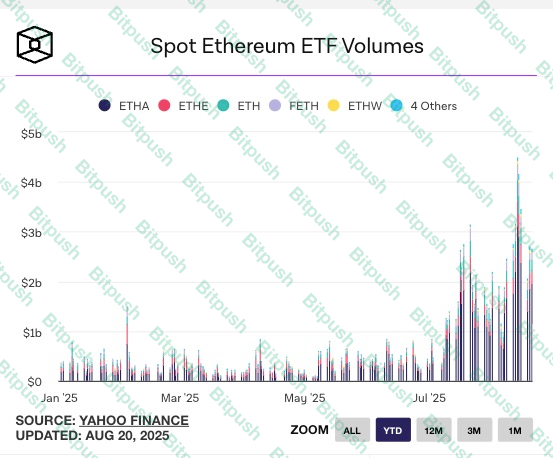

In July, the U.S. Congress passed the GENIUS Act Stablecoin Bill, providing a significant regulatory boost for the crypto market. That same month, spot Ethereum ETFs attracted a record $5.4 billion in inflows, nearly matching those of Bitcoin ETFs.

However, in August, Bitcoin ETFs saw modest outflows, whereas Ethereum ETFs continued drawing net inflows. This divergence in fund flows directly catalyzed Ethereum’s outperformance over Bitcoin.

Meanwhile, markets are awaiting the September vote on the “Crypto Market Structure Bill.” Investors widely anticipate this will be another major turning point, similar to the impact of stablecoin regulation. Under the combined influence of policy and market expectations, Ethereum’s position in the capital markets is rising rapidly.

II. Four Key Factors: Why Is Ethereum Outpacing Bitcoin?

JPMorgan analyst Nikolaos Panigirtzoglou and his team identified four core drivers behind Ethereum’s outperformance:

1. The Potential Approval of Native Staking

A standout feature of the Ethereum ecosystem is its proof-of-stake (PoS) mechanism. Users need at least 32 ETH to operate their own validator node, a threshold that remains high for most institutional and retail investors.

If the SEC ultimately allows spot Ethereum ETFs to participate in staking, fund managers could generate additional yield for investors without requiring them to run their own nodes. This would transform spot ETH ETFs from simple price-tracking tools into yield-generating passive investment products.

This is a key difference from spot Bitcoin ETFs: Bitcoin does not have a native yield mechanism, whereas Ethereum ETFs could eventually come with “yield,” significantly enhancing their market appeal.

2. Growing Corporate Treasury Holdings and Engagement

According to JPMorgan, about 10 publicly listed companies have added Ethereum to their balance sheets, accounting for approximately 2.3% of ETH’s circulating supply.

More significantly, some corporates have gone beyond “buy and hold” by directly engaging in the ecosystem:

- Running validator nodes to earn staking rewards directly.

- Utilizing liquid staking or DeFi strategies, deploying ETH into protocols for additional yield.

This shows Ethereum’s evolution from a speculative asset to a sustainable corporate treasury allocation tool—a transformation Bitcoin has not yet fully achieved.

Corporate treasury participation provides a longer-term, more stable capital base and strengthens Ethereum’s market valuation anchor.

3. Regulatory Easing for Liquid Staking Tokens

The SEC had long raised compliance concerns about liquid staking tokens (LSTs) such as Lido and Rocket Pool, raising fears these tokens might be classified as securities and thereby restrict large-scale institutional involvement.

Most recently, however, SEC staff have signaled they may not view these tokens as securities, providing much-needed clarity. Although not codified into law, this shift has significantly eased institutional apprehensions.

With compliance risks reduced, capital that had hesitated is now more likely to move rapidly and in greater volume into Ethereum staking and derivative markets.

4. ETF Redemption Mechanism Enhancement: In-Kind Redemptions Approved

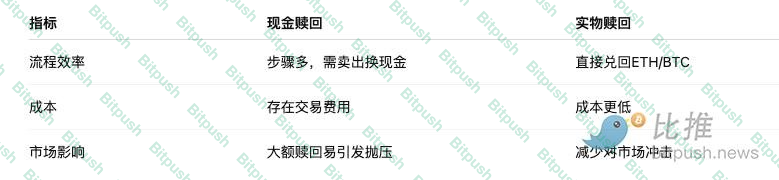

The SEC has recently greenlit in-kind redemption mechanisms for spot Bitcoin and Ethereum ETFs. Institutional investors can now redeem ETF shares by directly withdrawing the equivalent in Bitcoin or Ethereum, without having to liquidate for cash first.

This change brings three major advantages:

- Greater efficiency—saves time and reduces costs.

- Enhanced liquidity—connects ETF and spot markets directly.

- Lower market impact—reduces the risk of large-scale sell-offs on redemption.

While both Bitcoin and Ethereum benefit from this framework, Ethereum’s lower current share of institutional and corporate holdings means greater room for expansion and a more pronounced marginal impact ahead.

III. Outlook: Has Ethereum’s Potential Surpassed Bitcoin?

JPMorgan’s report highlights that while Bitcoin remains the crypto market’s leading store of value, Ethereum’s growth runway is even broader:

- ETF adoption: ETH ETF assets are still smaller than BTC’s, but with staking functionality, more long-term capital is expected to follow.

- Corporate adoption: Bitcoin has seen broad corporate and institutional uptake, while Ethereum is still in its early stages—leaving tremendous upside potential.

- DeFi and ecosystem: Ethereum is not only a digital asset, but the backbone for DeFi, NFTs, stablecoins, AI-enhanced on-chain computation, and more, offering a wider range of use cases.

In short, Bitcoin is “digital gold,” while Ethereum is quickly becoming the “infrastructure of the digital economy.”

IV. Conclusion

JPMorgan’s analysis underscores that Ethereum’s recent strength is not the result of short-term speculation, but stems from the combined effect of favorable regulatory developments, improved ETF structure, growing institutional adoption, and yield potential.

As ETF mechanisms mature, corporate treasuries keep accumulating ETH, and with possible future SEC policy confirmation, Ethereum could soon close—and even surpass—Bitcoin’s market lead.

For investors, this trend signals not just capital rotation but a possible inflection point for the entire crypto market, shifting from a singular store-of-value focus to a multi-dimensional application ecosystem.

In this new chapter of crypto, Bitcoin may still be “digital gold,” but Ethereum is rapidly emerging as the “heart of the digital economy.”

Disclaimer:

- This article is republished from [BitpushNews]. Copyright is retained by the original author [BitpushNews]. If you have any concerns regarding this republication, please contact the Gate Learn team, and we will address the issue promptly following our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Translations into other languages have been provided by the Gate Learn team. Translated articles may not be copied, distributed, or plagiarized without explicit attribution to Gate.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge